reverse tax calculator australia

To figure out how. An error margin of 001 may appear in reverse calculator of Canada HST GST and PST sales tax.

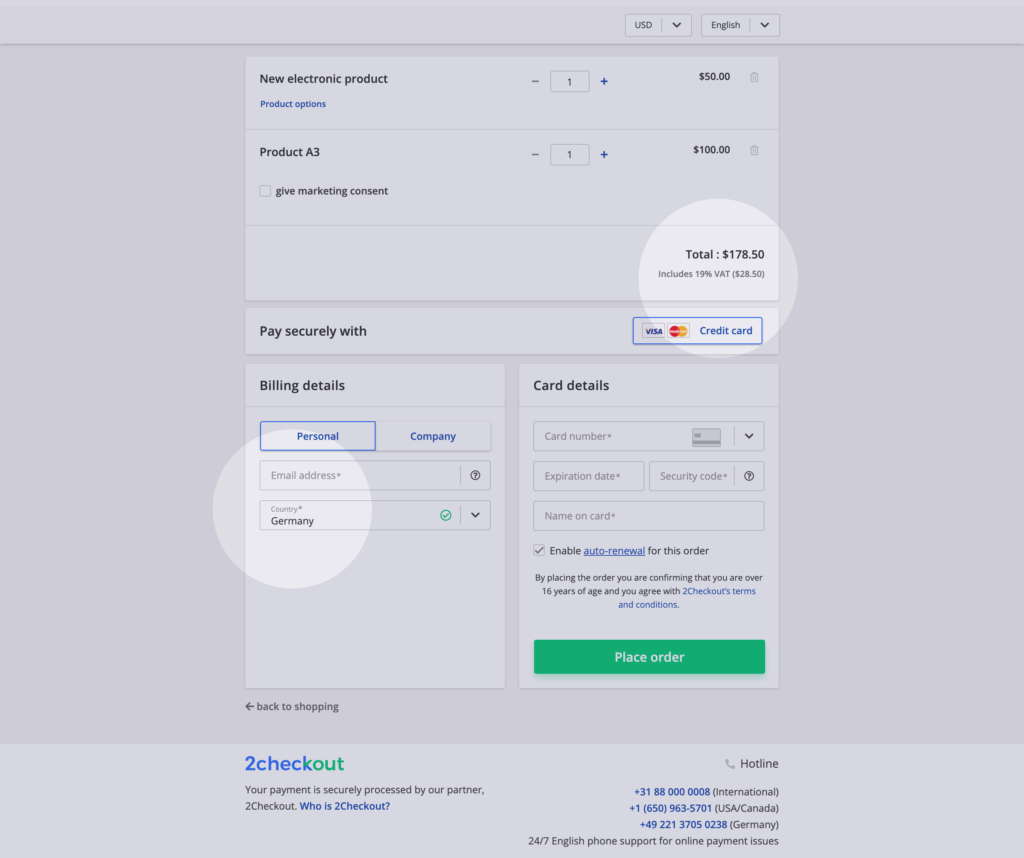

Best Practices For Sales Tax Display In The Checkout

Web The reverse tax calculator calculate net earnings to gross earnings.

. Web This Australian GST calculator adds 10 to determine a GST-inclusive amount and also allows a reverse calculation to determine an included GST amount or. Our Australian tax calculator is the easiest way to work out what youll owe and earn. Web Reverse Tax Calculator is a simple financial app that allows you to quickly and easily figure out just how much of that sales total was actually taxes.

3572 plus 325c for each 1 over 37000. The reverse sale tax will be calculated as following. Web To calculate Australian GST at 10 rate is very easy.

Due to rounding of the amount. Web The gross pay estimator will give you an estimate of your gross pay based on your net pay for a particular pay period. When adding 10 to the price is relatively easy just multiply the amount by 11 reverse GST calculations are quite tricky.

Web Reverse Sales Tax Calculations. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. 19c for each 1 over 18200.

Web Australian income is levied at progressive tax rates. Web This easy-to-use calculator can help you figure out instantly how much your gross pay is based on your net pay. 500 is GST exclusive value.

Just multiple your GST exclusive amount by 01. Web We have just released our Reverse Tax Calculator which calculate net after tax earnings to gross before tax earnings. 500 01 50 GST amount.

Web How to calculate GST in Australia. Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state. A pay period can be weekly fortnightly or monthly.

The calculator takes into account Medicare Levy and the Low Income Tax Rebate but does not take into. Web Have you ever wondered how much you paid for an item before the sales tax or if the sales tax on your receipt was correct. Foreign residents are taxed at a higher rate and arent.

Web The Harmonized Sales Tax or HST is a sales tax that is applied to most goods and services in a number of Canadian provinces. Web You will need to use the Income Tax Estimator calculator to provide a breakdown of the income and your residency status. Here is how the total is calculated before sales tax.

Tax bracket start at 0 known as the tax-free rate and increases progressively up to 45 for incomes over 180000. New Brunswick Newfoundland and Labrador Nova. Web How to Use the Tax Calculator for Australia.

Web Margin of error for HST sales tax. Now you can find out with our Reverse Sales Tax. Just enter your yearly monthly or weekly salary and.

Web Tax on this income. Web The invoice bill to the customer will be 105000 100000 5000 and it is known as the total sale include tax. You can use tax rates from 2013 to 2002 and.

This app is especially useful to.

Financial Calculators Full Listing

Best Excel Tutorial How To Calculate Gst

Tax Rate Changes From The 2020 21 Budget Benefit Accounting

Markup Calculator And Discount Calculator

India Social Security Rate For Employees 2022 Data 2023 Forecast

Salary Pay Tax Calculator Suburbsfinder

Markup Calculator And Discount Calculator

Best Excel Tutorial How To Calculate Gst

Income Gross Up Calculator Integrity Finance

Perth Mint Gold Bullion Sales In March Rank Third Best Coinnews

Australia S Cryptotaxcalculator Helps Traders Demystify The Decentralized Techcrunch

How Are Dividends Taxed Overview 2021 Tax Rates Examples

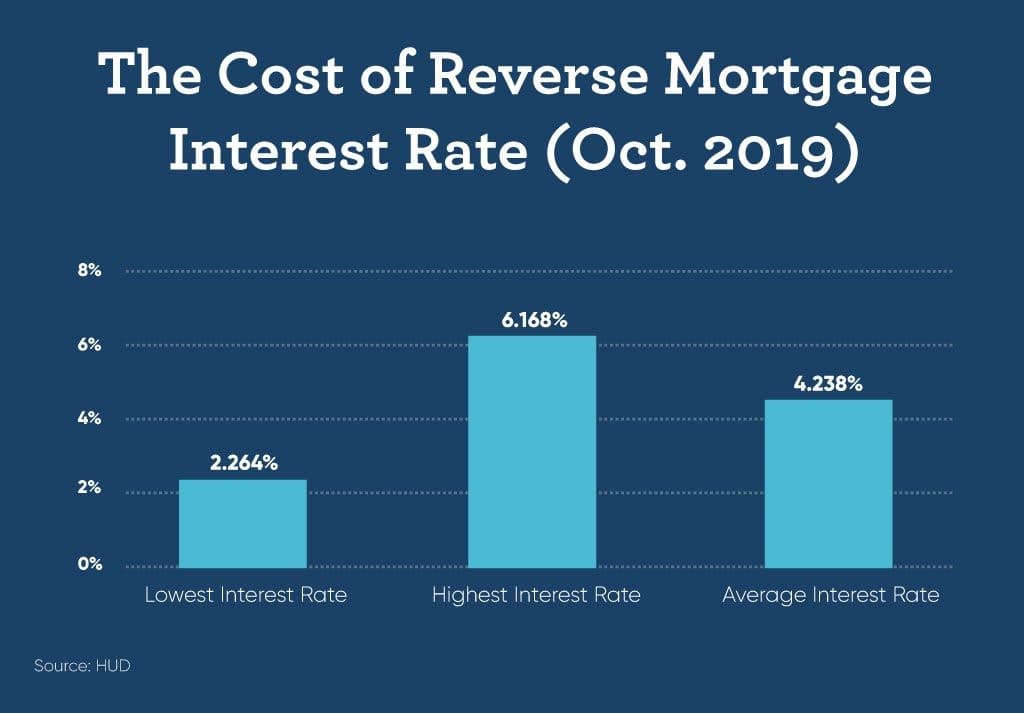

Reverse Mortgage Interest Rates 2021 Fixed Variable Goodlife

![]()

Free Income Tax Calculators Australia Ashburn Tax Accountants

Australian Income Tax Calculator Chardon Home Loans Mortgage Broker In Glebe Nsw

Stripe Tax Automate Tax Collection On Your Stripe Transactions